Support and resistance levels offer two core concepts in technical analysis that help traders and investors to spot possible points where they can decide to buy or sell.

Support and resistance zones and levels are extremely important for those who want to know when it is time to buy or sell.

To continue our series on useful trading strategies, we want to provide you with another tool that you can integrate with your technical analysis and trading techniques – like trend trading and swing trading – so that you will be able to avoid the Random Walk Theory and locate possible zones where trends are about to change, or when it’s time to accumulate.

What Are Support and Resistance?

Support and resistance levels make reference to two different zones in charts.

As usual, being aware that markets are about people and not about money, we will analyze these two powerful notions with people’s behavior in mind.

To start with some definitions, let’s quote Rolf Schlotmann and Moritz Czubatinski, authors of Trading: Technical Analysis Masterclass, who provide a very simple definition:

“Support and resistance are price levels at which the price has previously shown a reversal reaction.”

Support represents the level at which the price stopped its downward movement to begin an uptrend; resistance is the opposite: at this level, the uptrend is blocked, and a downward movement begins.

To better locate these levels, technical analysts draw lines that link all the points where the price showed different behavior. As with trends, the more points you manage to link, the stronger is the support or resistance line – but there is also another aspect to consider, as we will see later.

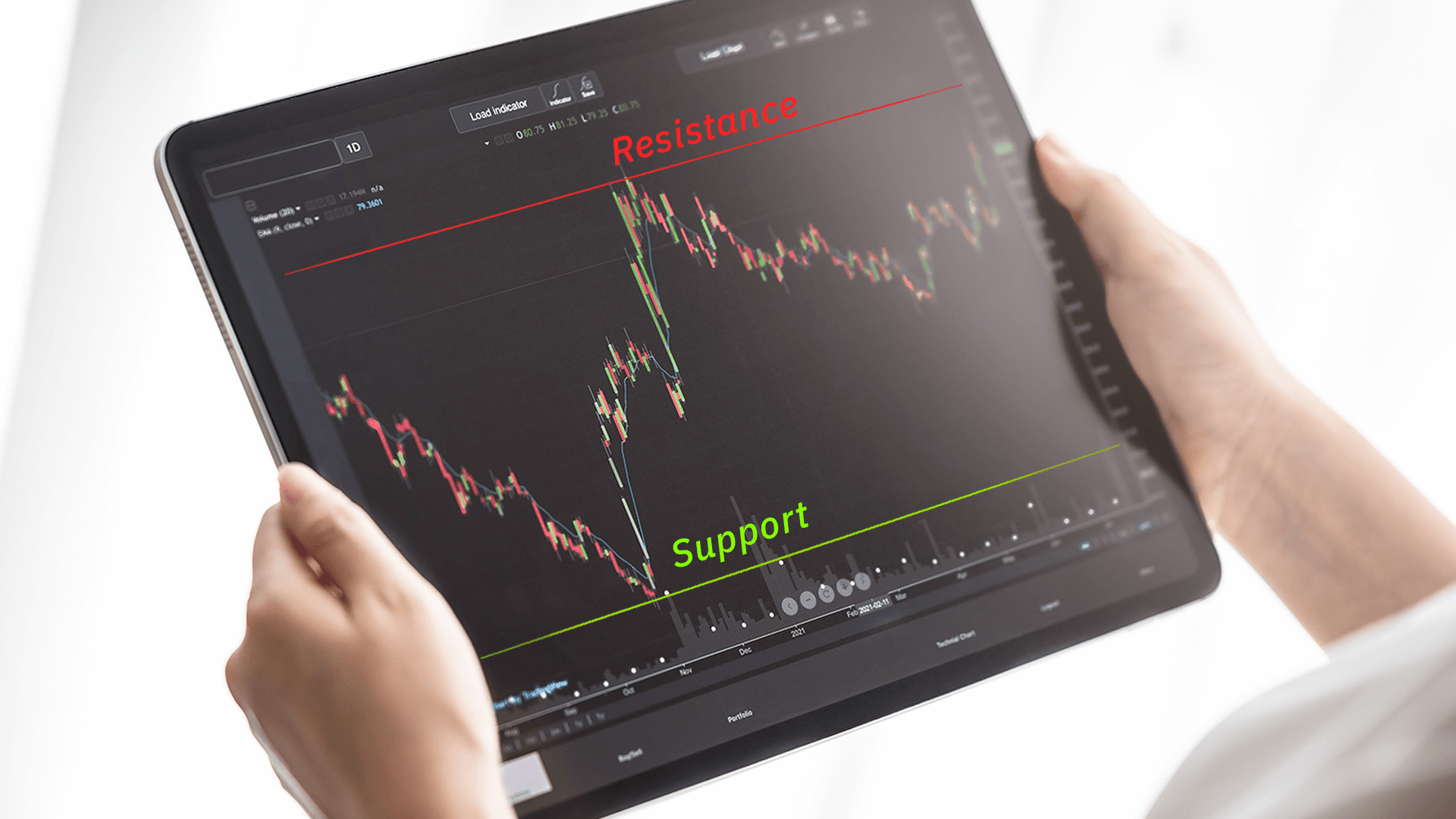

The image below offers examples of support and resistance levels:

Pro tip: Consider that support and resistance levels are not necessarily horizontal lines; they can also be diagonals. Actually, they work like trends, the difference between these lines and trend lines lies in the different concepts they represent. While technical analysts use trend lines to understand how the price is moving, support and resistance lines are used to understand when it is time to buy or sell an asset.

BTSEUSD – 4h chart. Source: TradingView

In this 4-hour chart of the BTSE/USD price we merged two types of charts: the line chart to better show you the behavior of the price; the candles chart to make a more complete technical analysis. They both show the same asset during the same period of time.

This image clearly shows that the support and resistance levels we draw are pretty strong: we managed to link at least three points where price shows the same behavior – so, where traders and investors do the same thing.

As we mentioned at the beginning of this article, we want to analyze charts with people in mind: support and resistance levels are important and powerful because people who are opening positions in that specific market do the same thing every time a price reaches a specific level – at least as far as something changes.

At the support level, bulls defend – support – the price, preventing it from moving far downwards.

At the resistance level, bears do not permit bulls to take the price above the line.

As usual in markets, the self-fulfilling prophecy is in place: support and resistance zones are important because they signal those levels at which, for some reason, traders and investors are convinced that it is time for a reversal.

The actions of traders and investors create a sort of channels, ranges within which we can (almost) safely act. Of course, acting within these lines is not the best way to make huge profits – unless relatively large sums of capital are used or if the channel is not large enough.

The way to use them is straightforward: it is safe to suppose that we should sell when the price hits a resistance level and buy when it hits a support level.

If you are used to automating your trading activity, support and resistance levels are also useful to set stop losses and take profits.

But support and resistance do not act alone, and we should not see them as if they were isolated elements. In technical analysis, the more information and patterns converge, the more our predictions will be accurate.

When Support Becomes Resistance, And Resistance Becomes Support

This is a fundamental aspect to take into account, something that gives you even more powerful and reliable information.

Making this kind of analysis and locating zones where support turns into resistance and vice versa means that you are merging all your knowledge about support and resistance and are taking a further step.

Support and resistance levels, as well as trend lines, help analysts to make a sort of microanalysis, to observe and locate specific events. But if we look at the big picture, we will see that they allow us to identify more complex and long-term patterns.

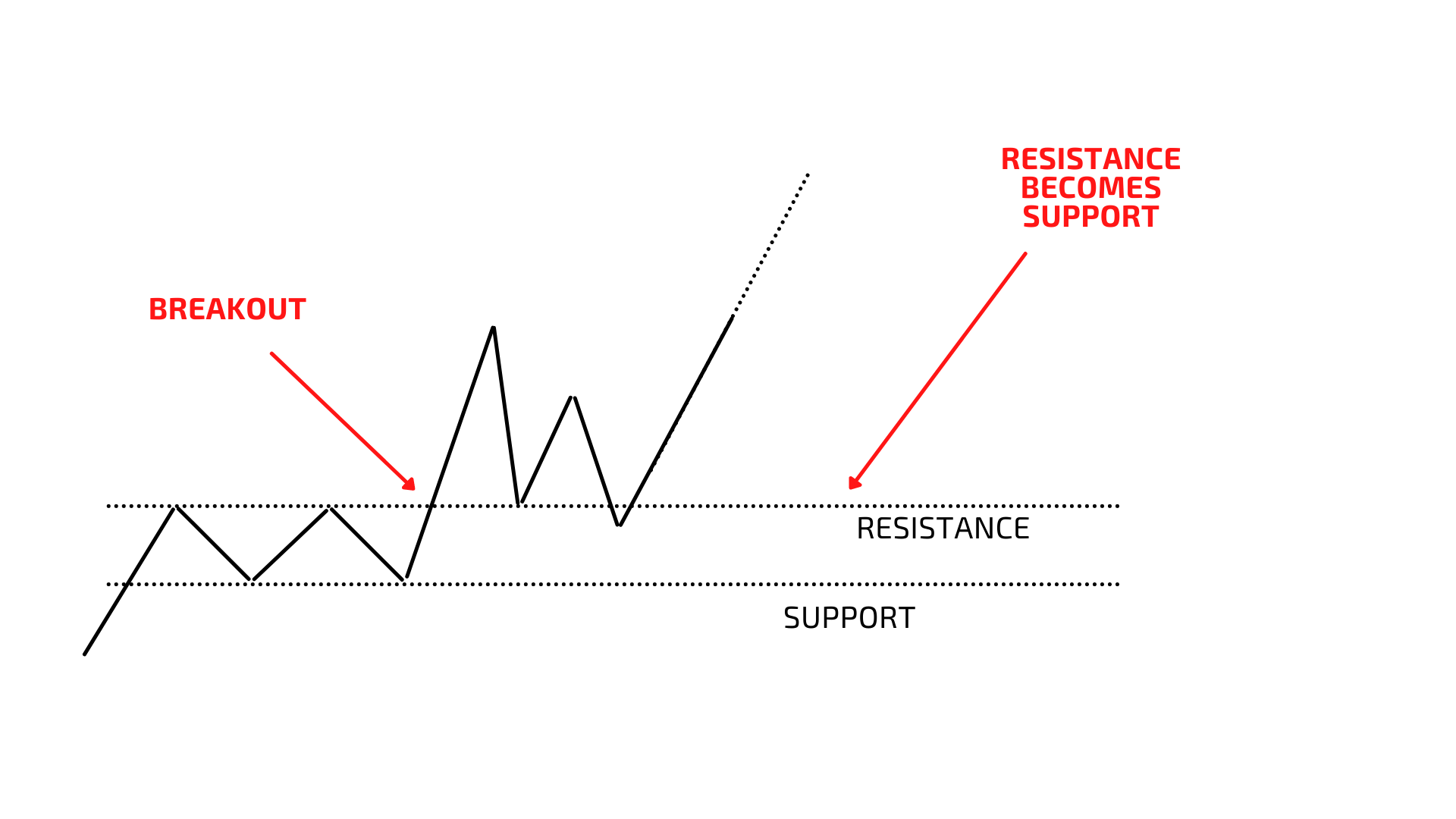

Let’s observe the image below – a simulation of what often happens in markets (and a good exercise to further develop your capabilities as an observer):

As we can see, there is a channel formed by support and resistance lines.

As we mentioned, support and resistance last until something changes, and that breakout means that something has changed: usually, a strong breakout appears with a peak in volume. Buyers are now stronger, but before we can be sure of that, the price will decrease again. Sellers do not disappear: the most natural – also most evident – level, where buyers will stop sellers, is that resistance line that now becomes a support. As usual, to be sure that the nature of that line changed, we have to wait for a retest.

But how can we be safely sure that the price will not fall again? Why would we be able to predict a breakout?

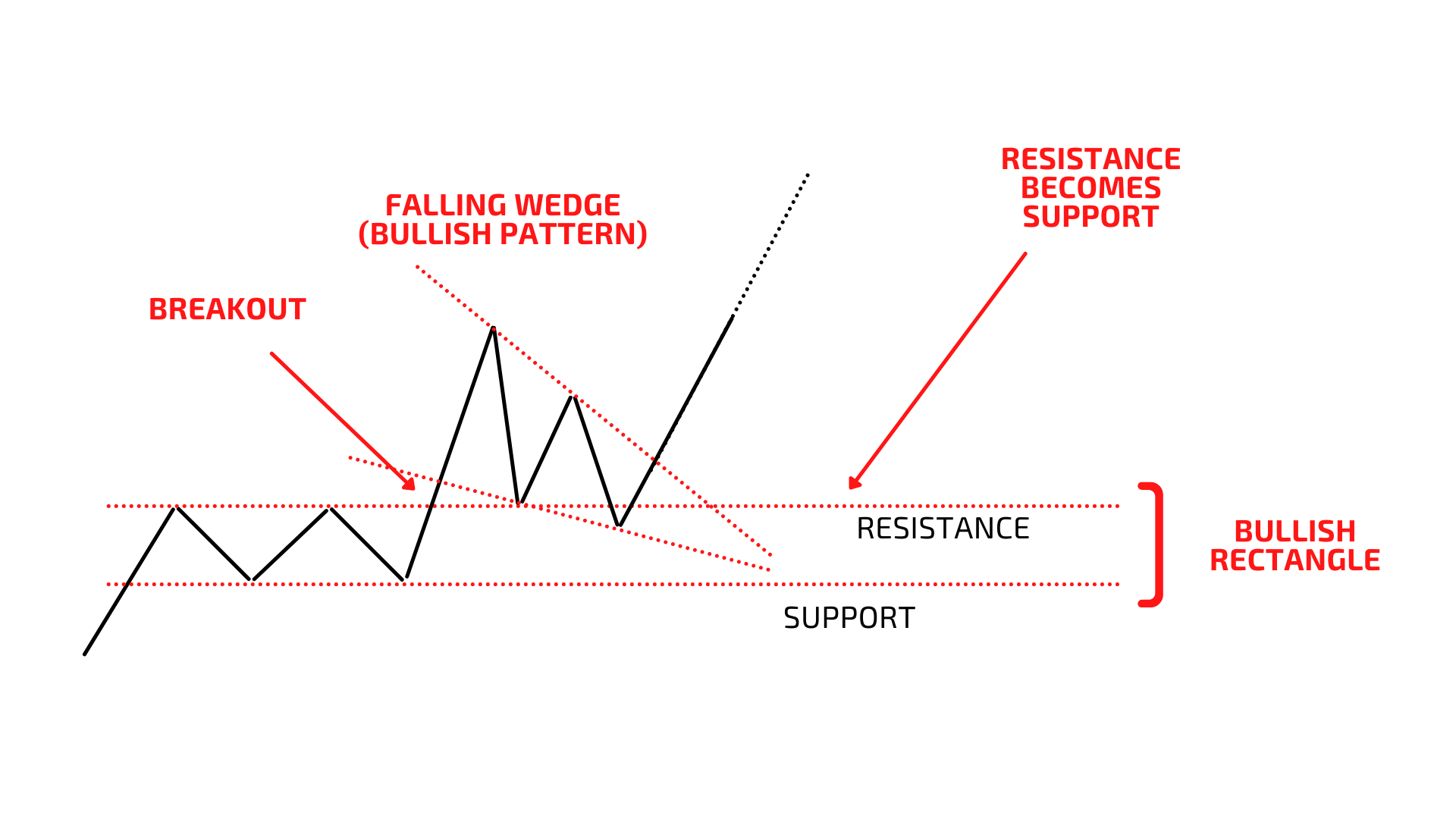

Let’s look at the big picture because what we have observed so far happens at the “micro-level”:

The two lines, support and resistance, formed what is called a bullish rectangle, a bullish pattern that usually occurs as a pause during an uptrend, as a sideways movement that represents a consolidation period.

After the consolidation, a breakout occurs, then the price will retest, using what was the resistance line that now becomes a support. The breakout and retests form another bullish pattern, called a falling wedge.

Of course, the whole process can also occur the other way around, usually when the support line becomes a resistance.

But we also need to consider other logical aspects and evaluate the strength of buyers and sellers by looking at volumes.

A Little Note on Order Absorption

Order absorption is the phenomenon that influences trend reversals.

As we mentioned earlier, trend lines, support and resistance are stronger if the analyst manages to link more than two points. But it is also true that the more times a price reaches the same level, the more it weakens.

Let’s analyze this phenomenon from a buyer’s perspective. If buyers are strong enough to start an uptrend, they will try to keep that uptrend to maximize their profit.

During an uptrend, when buyers meet a resistance line it means that sellers are selling at that specific price. This will make the price drop (retest), but buyers will form a support line.

The second time the price reaches that resistance line, there will be fewer sellers – in fact, we usually see a decrease in volume, or at least a relatively stable number of participants. The more times the price will reach that level, the fewer buyers there will be.

At a certain point, the number of sellers will be so low that buyers will be able to strengthen the uptrend.

Final Thoughts

Support and resistance are two important and strong concepts in technical analysis. Their main function is to signal zones where a trend or wave is about to reverse: traders and investors can use them to open long and short positions, and to set take profits and stop losses.

But they also help us to make analysis at a micro level while the big picture, with more complex and long-term patterns, is formed.

Linking together more information and patterns, as shown in this article, will help us to better manage our trading activity and make more reliable predictions.

Our aim is to create a platform that offers users the most enjoyable trading experience. If you have any feedback, please reach out to us at feedback@btse.com or on Twitter @BTSE_Official.

Note: BTSE Blog contents are intended solely to provide varying insights and perspectives. Unless otherwise noted, they do not represent the views of BTSE and should in no way be treated as investment advice. Markets are volatile, and trading brings rewards and risks. Trade with caution.