I frequently ask myself the question of what Bitcoin will look like in 2030. Some things will obviously be the same (the maximum issuance of coins will still be 21 million), but inevitably some new ideas and complementary technologies will be adopted. With governments racking up debt at an alarming rate and printing money out of thin air, this digital gold to escape authoritarian reach in money, capital controls, and severe inflation is sure to garner interest in the years to come.

This political and monetary climate opens the door to hundreds of millions, if not billions, of individuals that may look to Bitcoin as their lifeboat in the following decade. How can we get there with a limited transactional throughput which is estimated at around 7 transactions per second? More importantly, how can we scale Bitcoin without compromising its value propositions of scarcity and censorship resistance?

Decentralization has been the key to Bitcoin’s success thus far, and it will be even more crucial in the future. One solution, in particular, presents itself as a way to balance our decentralized values and ambitions for a Bitcoin standard. The Lightning Network is that solution, and it’s just getting started.

What Is The Lightning Network?

The Lightning Network is a decentralized protocol layer that allows for instantaneous Bitcoin transactions with little to no fee, without intermediaries. There are dozens of teams building out the Lightning Network protocol, software implementations, applications and businesses in 2020, with new ones contributing revolutionary ideas and products every week. The best part? Lightning is currently live on the Bitcoin network, actively being used today.

To achieve decentralized consensus on what Bitcoin’s transaction history is, we needed to make every little transaction detail transparent for all to verify. Satoshi implemented the world’s first functioning blockchain to store this data. While allowing decentralized consensus, Bitcoin’s blockchain-based infrastructure also comes with tradeoffs, in that it decreases privacy and limits throughput. Fortunately, off-chain transactions can help fill those gaps. Satoshi recognized this in the early days of Bitcoin and even toyed with it himself for a time.

On Bitcoin’s version 0.1, Satoshi implemented the features of time locking (funds can’t get spent before a certain date) and the ability to replace a transaction before it’s included in a Block. This allowed users to do “Nakamoto high-frequency transactions” which was the earliest form of standard off-chain transactions. This method wasn’t popularized, and many details around this were only discovered through the revelation of a private email by a fellow developer, Mike Hearn, in 2013. While this early attempt at off-chain transactions was far from secure, leaps and bounds have now been made with a new alternative via the Lightning Network.

The Lightning Network white paper came out in February 2015 and was published by software developers Joseph Poon and Thaddeus Dryja. To enable the desired features mentioned above, Lightning combines two main technologies: Payment channels and HTLCs (Hash Time-Locked Contracts).

A payment channel allows users to make as many transactions as they want between themselves with a set amount of coins before reporting the final state of their arrangement to the network. It begins with one or both users putting up some coins with an initial state reported to the blockchain. Let’s say Alice controls 10 000 satoshis and Bob controls 20 000 satoshis. They’re playing multiple (6) rounds of blackjack and every time one loses, they have to send 1000 satoshis to their counterparty.

Alice loses twice and each time, she sends the required 1000 satoshis for a total of 2000. Bob loses three times, sending back his previous winnings plus an additional 1000 satoshis, for a total of 3000. In the final round, Bob loses again, sending an additional 1000 satoshis to Alice. Given this is the last transaction, they report the final state of the channel to the whole network for it to be included in the blockchain. In aggregate, 6 games were played with off-chain transactions happening each time. All settled, Bob loses 2000 satoshis and Alice gains 2000. This is what gets settled on-chain.

To summarize: Alice and Bob have made 7 transactions between them but the network only saw 2 happen. The 5 transactions in between were never seen by anyone else and neither of them had to pay any on-chain fees for them. At any point in this process, either of the two parties could have abandoned the game and reported the latest state to the network. That’s the magic of off-chain transactions – transactions are near instantaneous and immediately spendable while reducing the amount of data necessary to be conveyed on-chain.

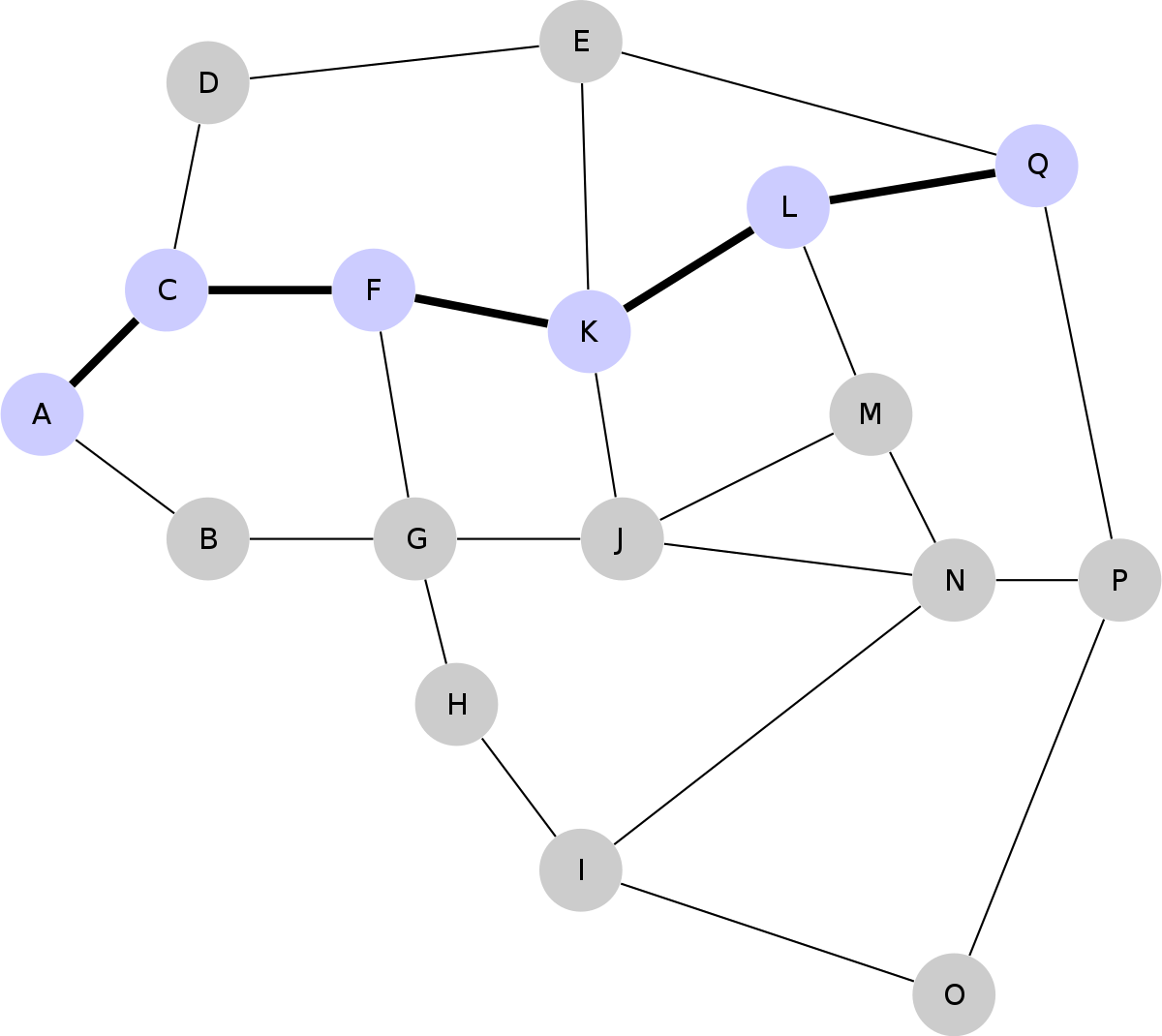

Image: Channel creation, off-chain transactions, and final settlement

Of course, it would be ineffective to open channels with every party you want to cheaply and fastly transact with. HTLCs are the missing piece to improve that particular user flow. If Carol joins Alice and Bob in their game of Blackjack, she only has to create a payment channel with one of them, Alice. It’s possible for the other one, Bob, to route through his channel with Alice to get to Carol. This won’t make Alice an intermediary that can confiscate funds because a cryptographic contract will immediately transfer the funds to Carol. In exchange, she can request a routing fee for the service. These fees are much cheaper than on-chain transactions, and in some cases are entirely free. Anyone charging exorbitant fees will likely be routed around with more cost-efficient channels.

Image: Routing through the lightning network

Obviously, this is just the basic concept of the second-layer Network. As of April 2020, there are 12 400 participant nodes flowing nearly 1000 bitcoins through more than 36 000 channels. It’s clear that Lightning is on track to making Bitcoin an extremely scalable monetary and payment system.

Lightning is the Altcoin Killer

Altcoins began to emerge shortly after the creation of Bitcoin, and many were initially announced on the famous discussion forum BitcoinTalk. The first, Namecoin, came around in April 2011. All of these coins have promised to provide what Bitcoin lacks, primarily revolving around three main features: scalability, privacy, and programmability.

The “Fast and Cheap” Altcoin was probably the most common in the early days and many still remain at the top of coin listing websites and trading platforms. They are proud of enabling everything that Lightning already does better: fast, cheap transactions of any size. I can also make fast, cheap entries of any size on Public Google Sheets, but am I enabling censorship-resistant transactions of the scarcest asset on earth? Certainly not. By simply allowing for greater transactional throughput via larger and more frequent blocks, large tradeoffs are made in the realm of self-verification via your own node. You can read more on the importance of nodes in my previous blog post. To explore more about past “big block” scaling attempts and their failures, check out this op-ed by Vlad Costea.

The “Privacy” Altcoin marked a second wave of projects. While exploring interesting technology breakthroughs, some rushed to their implementation. All share a common problem in that they obfuscate the base supply of coins. If exploited, this could enable an attacker to inflate the currency to infinity as the users are none-the-wiser. If this happened on any coin with an auditable supply, it would be immediately evident on the blockchain. On a privacy coin, this can be difficult, if not impossible to see and prevent. Lightning always requires Bitcoin to be locked up on-chain in a cryptographically provable way. This layered approach makes it impossible to create additional coins within the base currency, while every transaction is off-chain and onion routed – affording the user additional privacy benefits.

The incredibly malleable “Move Fast And Break Things” Altcoin is pretty much every other project outside of the two previous arguments. They are young and constantly iterating, so they can adopt technologies before “the Dinosaur” Bitcoin can.

Contrary to the above line of thinking, Bitcoin’s difficult-to-modify nature is its greatest strength. This quality proves that no one entity has control over the protocol, it greatly reduces the risk of bugs entering its code through unproven technologies, and it gives the greatest degree of certainty around monetary policy in the entire ecosystem. Fortunately, off-chain networks like lightning do not put Bitcoin’s base protocol at risk, so development can move much faster while mitigating risk. Waves of new developers continue to join Lightning and develop new applications every day. Creating and maintaining a new global monetary system is a hell of a complicated job. By building atop Bitcoin, Lightning teams can innovate at their own pace while leaving the hard work of Bitcoin’s core devs intact.

“Lightning can’t beat the Programmable Altcoin”

Yes, the Programmable Altcoin is the most advanced form and the most popular, and it might seem hard to see how Bitcoin can rival it.

To the surprise of many, Lightning has proved it serves more than simply fast and cheap transactions. By attracting the most advanced development talent in the industry lightning is beginning to challenge even the Programmable Altcoin.

Lightning allows for uncensorable, encrypted, peer-to-peer, and onion-routed decentralized chatting capabilities. There are many teams building out this super useful feature, with the most popular of them being the Sphinx App. It is currently in a public beta.

The main Lightning development team, Lightning Labs, has also invented LSAT (Lightning Service Authentication Tokens) that can enable website users to authenticate to a web service with the Lightning identity instead of a regular login. This technology can also be used as a paid API (Application Programming Interface) where developers can pay Bitcoin to service through Lightning every time they fetch data.

These examples are just some of the concepts that further prove not only the usefulness of a layered scaling approach but also the redundancy of creating new blockchains with their own monetary unit simply to address a niche use case that can (and will) eventually be built atop Bitcoin.

Conclusion

Ever since I discovered Bitcoin and I stacked my first satoshi, my life has completely changed. Now more than ever, I realize how lucky we are to have this amazing tool at our disposal. The Lightning Network will allow for billions of future users to feel the same way I do.

It’s amazing how much Lightning improves key Bitcoin parameters that the base layer wasn’t designed to. However, we aren’t going to build a sound monetary system for the 21st century in only a few years. Patience is a virtue as the protocol continues to ossify. Fortunately, barring a couple of hiccups in the early days, Bitcoin has worked since day one with near-zero downtime. Building out new features in layers like the Lightning network will allow us to maintain that stellar track record.

Our aim is to create a platform that offers users the most enjoyable trading experience. If you have any feedback, please reach out to us at feedback@btse.com or on Twitter @BTSE_Official.

Note: BTSE Blog contents are intended solely to provide varying insights and perspectives. Unless otherwise noted, they do not represent the views of BTSE and should in no way be treated as investment advice. Markets are volatile, and trading brings rewards and risks. Trade with caution.