Hedge mode provides a way for futures traders to go both long and short on a single futures contract. This is in comparison to one-way mode, which only allows you to trade in one direction at a time.

In short, this means you can hedge your positions in case the market goes against your trade. This way, you don’t get liquidated and lose your entire principal.

At BTSE, we offer hedge mode for both the desktop and mobile app version.

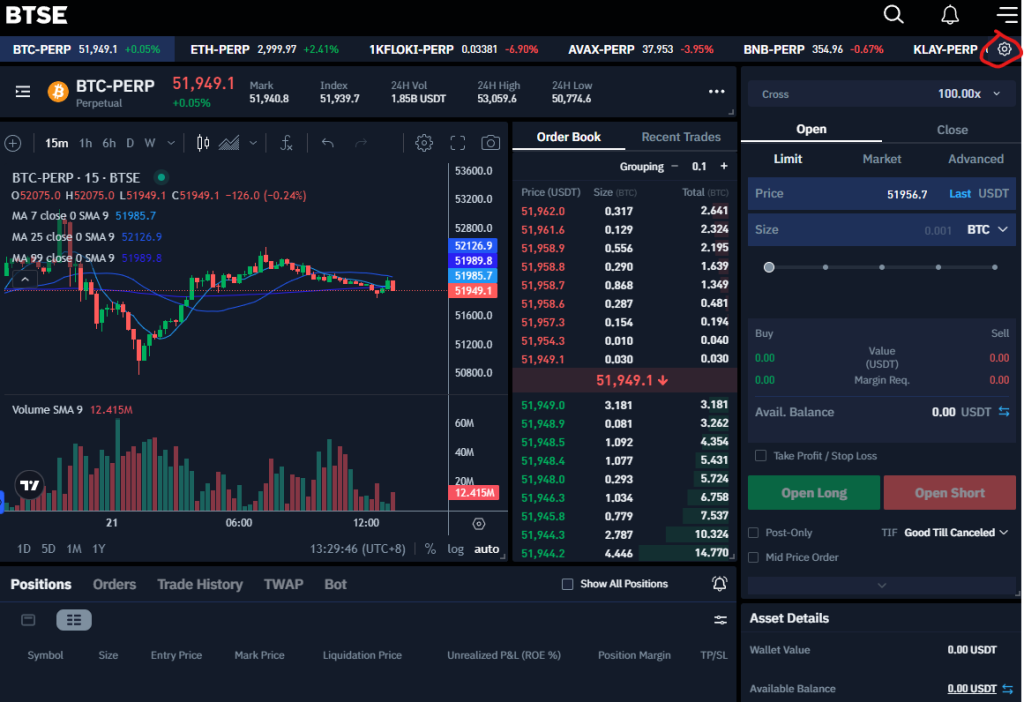

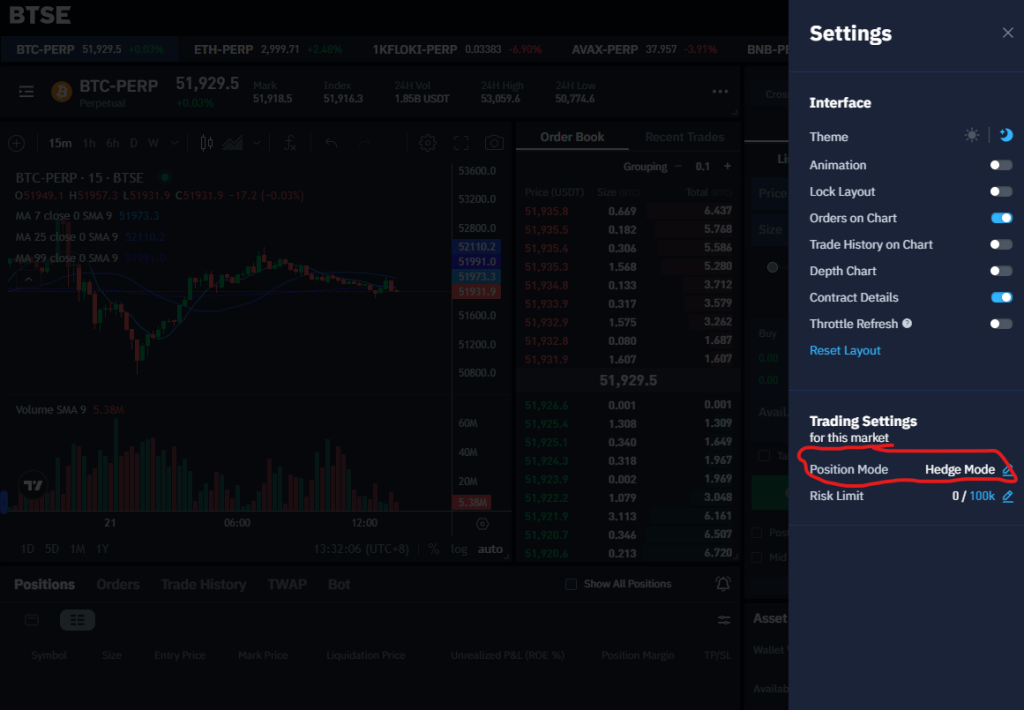

You can toggle on hedge mode for a particular contract – in the upper right hand corner you just have to go to settings and turn it on.

To give you an example, say that we put a long position on Bitcoin futures 100x leverage contract for 0.1 BTC initial margin.

If we turn on hedge mode, we can place an opposing position for 0.05 BTC initial margin. If the price drops, the money made from the short offsets the money lost from the long position.

You’ll still lose money – just not as much as you’d lose in one-way mode.

If the price goes up – then you’d make money on the long – but it’d be somewhat offset by the money you lost from the short position.

Here’s a video tutorial that explains it all.