Dear Traders,

BTSE is upgrading its risk limit mechanism for all futures markets to help you manage risk more effectively. This update is expected to become effective on January 11, 2026. Please review the key points below to avoid interruptions to your day-to-day trades.

What’s Changing?

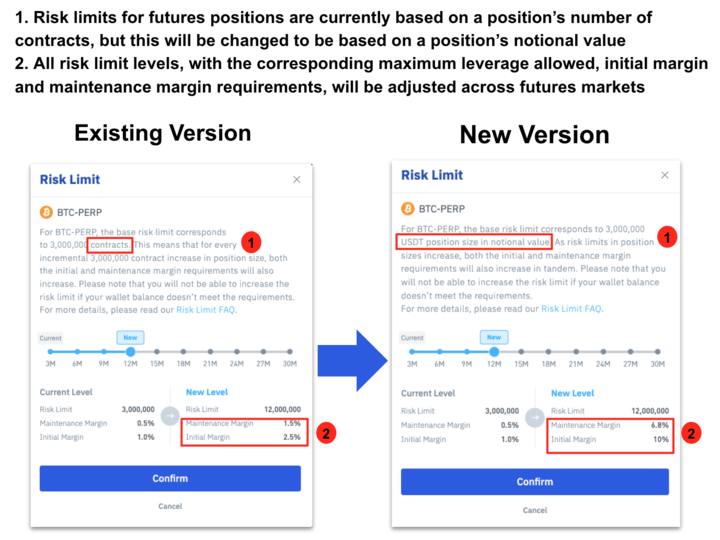

- Risk Limit Tiers to be Based on Notional Value:

Risk limits will now be based on your position’s notional value (in USDT), rather than contract quantity. - Tiered Margin Requirements:

Higher position values will require you to use higher margins and lower maximum leverage. For the risk limits of each trading pair, please refer to the risk limit information on this page. - API Changes:

Parts 2.1 – 2.3 for the Open Futures API will incorporate some adjustments to accommodate the above changes .For more details, please refer to these change logs.

What You Need to Do

If your position exceeds the current risk limit, you have a few options:

- Option 1: Increase Your Risk Limit Tier

Raise your risk limit tier to support a larger position. This will require you to add more margin and may affect your liquidation price. - Option 2: Reduce Your Position

Partially reduce your position to stay within your current risk limit.

If you do not take action:

- You can only reduce or close your position.

- You cannot place new orders that increase your position size for that respective market.

- Trading in other markets will not be affected.

How to Adjust Your Risk Limit

- Go to your BTSE trading page

- Select your position

- Click Risk Limit Settings

- Choose your desired risk limit tier

- Confirm the change

For step-by-step instructions, see our Risk Limit Guide. These adjustments have been made to better serve the evolving needs of our users, and is part of BTSE’s commitment to providing users with a quality trading experience.

Thanks for your support.